While most adult Singaporeans are well aware that they can purchase a new flat directly from the Housing Development Board (HDB) directly two times during their lifetime (a second bite at the cherry), some may not be aware that they can yet apply for another new flat for a third time in their senior years.

To start with, under what situation are you considered a first timer or second timer? Essentially, if you have enjoyed some kind of subsidised housing from the HDB like purchase of a new Build To Order (BTO) flat, Design Build & Sell Scheme (DBSS) flat or Executive Condominium (EC) apartment, or bought any resale HDB flat with CPF Housing Grants, or enjoyed a Selective En bloc Redevelopment Scheme (SERS) grant, that is counted as one time. So the next time you purchase a new HDB flat, you are considered a second timer for assessment of eligibility and priority. Of course if you have enjoyed the subsidy two times, you will be considered a third timer on your next purchase of a new HDB flat.

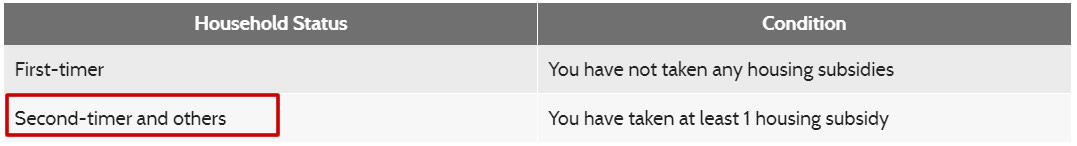

Here is HDB’s definition of first-timer applicant:

Yours will be treated as a first-timer application if you and any of the other listed owners and essential occupiers meet the following criteria:

- Not the owner of a flat bought from HDB, or an EC/ DBSS flat bought from a developer

- Not sold a flat bought from HDB, or an EC unit / DBSS flat bought from a developer

- Not received any CPF Housing Grant for the purchase of an HDB resale flat

- Not taken any form of housing subsidy (e.g. benefitted under the Selective En bloc Redevelopment Scheme (SERS) or HUDC estate privatisation)

If you are a second-timer and your spouse/ spouse-to-be is a first-timer, you and your spouse/ spouse-to-be will enjoy first-timer privileges and priority as a couple.

Here is HDB’s definition of second-timer applicant:

Yours will be treated as a second-timer application if any of the following applies to you or any of the other listed owners and essential occupiers:

- Have owned or sold any of the following:

- HDB flat bought from HDB

- Resale flat bought using a CPF Housing Grant

- EC unit / DBSS flat bought from the developer

- Once taken some form of housing subsidy (e.g. benefitted under the Selective En bloc Redevelopment Scheme (SERS), HUDC estate privatisation)

The above information can be found in both of these web pages:

Short-lease 2-room Flexi Flat

Community Care Apartments

The above links no longer work and the information contained therein have been combined by HDB into a single page for Seniors here:

Flat and Grant Eligibility for Seniors

Based on the old links, the following information was present implying a possibility for seniors to apply for a HDB BTO flat a third time:

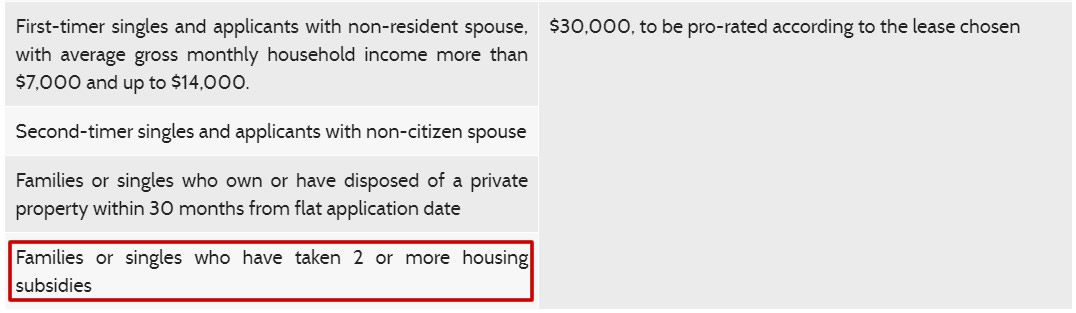

What is interesting is the following statements pertaining to applicants who have enjoyed housing subsidies two times:

For Short-lease 2-Room Flexi:

You would be considered to have enjoyed two housing subsidies if you or the essential family members listed in your application have owned or sold two or more subsidised flats. You may apply for a short-lease 2-room flat if you have not bought a Studio Apartment or short-lease 2-room flat previously. You will have to pay a resale levy adjusted from $30,000 based on the lease of the 2-room Flexi flat.

Along the same vein, for Community Care Apartments:

You will be considered to have enjoyed 2 housing subsidies if you and any of the listed applicant(s) and the essential occupiers have owned or sold two or more subsidised flats.

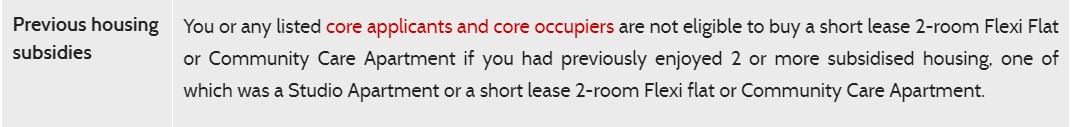

Based on the new web page, the same conclusion is drawn based on the following wordings:

Reading the following eligibility statement carefully:

You or any listed core applicants and core occupiers are not eligible to buy a short lease 2-room Flexi Flat or Community Care Apartment if you had previously enjoyed 2 or more subsidised housing, one of which was a Studio Apartment or a short lease 2-room Flexi flat or Community Care Apartment.

That tells me even if you have enjoyed a total of 2 subsidised housing, so long as these 2 subsidised housing does not include a Studio Apartment or a short lease 2-room Flexi flat or Community Care Apartment, you can apply for one.

This means seniors aged 55 and above can apply for a Short-lease 2-Room Flexi flat from HDB while seniors aged 65 and above can apply for a Community Care Apartment flat from HDB even after having enjoyed housing subsidies two times previously.

On top of that, those who are presently living in private properties can apply for the above two flat types from HDB without having to wait out 30 months after sale of existing private properties. All they need to do is sell away their private properties within six months of collecting the keys to their new BTO flats.

Like second-timers, resale levies apply for third timers, but the amounts are pro-rated based on the shorter lease of the flat, depending on various factors.

Regardless, these two housing types from HDB substantially increases the range of options available to seniors for their housing needs in their golden years.

What do you think? Let us know!

Hi,

My hubby & i have purchased Bto once in 1998 & sold in 2007. In 2014, we purchased a 4rm resale flat which we currently stay. Can we apply for the Sales of balance flat(4rm) next year? If can, pls advise what & how should I go about to differ the down-payment for new flat upon our current flat sold? Our main motive to apply for new flat & sell our resale flat that able to bring down the housing loan very much lesses with the increases of the high selling price. As my hubby is going 55yrs old next year & I going 52 yrs old. We sincerely hope that we can very much lower down the loan payment by doing so. We still got 3 schooling children (2 girls, 1 boy). Please help & advise. Thanks

Hi Jowie

Correct me if I am wrong, essentially you are asking how you can defer the payment of the downpayment for your new SBF.

Assuming you intend to take a loan for this new flat, then the relevant HDB schemes to look into are:

Staggered Downpayment Scheme

Deferred Downpayment Scheme

(see https://www.hdb.gov.sg/residential/buying-a-flat/buying-procedure-for-new-flats/sign-agreement-for-lease)

However, in the case of Staggered Downpayment Scheme, you cannot qualify if you buy a 4-Room flat, as the scheme is geared towards young couples or flat owners right-sizing to 3-Room or smaller flats.

In the case of Deferred Downpayment Scheme, it is meant for seniors aged 55 years and above. In your case, while your husband will turn 55 next year, you will still be below 55. Unless you are prepared to buy using your husband’s name only (relying only on his CPF funds and using only his name to get a loan), with you as a core member instead of a buyer, you may not qualify. Since you will be informed of eligibility of this scheme only during the booking appointment, it is best to check with HDB before hand by making an appointment to be very sure. Also, this scheme similarly applies only if buying a 3-Room or smaller flat.

A possible solution is to get a bridging loan from a bank to help with the downpayment. But do note bridging loans typically have a tenure of 6 months, hence you need to plan such that you are able to sell your old property within this period in order to settle the loan. Of course, do bear in mind that a loan will require you to pay interests on the sum borrowed.

Another possible solution is to apply for SBF flats that are not near completion yet so that you can sell your existing flat and receive the sales proceeds first, and have ready funds when downpayment is due. In the interim, you can rent or find alternative housing arrangements. You may even try to appeal to HDB to get PPHS rental also.

Hope this helps.

I purchased my first flat which is a resale flat with housing grants, then my second flat which is a resale flat and took proximity grants. For my third flat, can I go for BTO?

hi Yvonne

If your purchase of 2nd HDB resale flat does not utilise any housing grants, except for the proximity grant, then you can still apply for BTO as a 2nd timer. This is, of course, provided that you have met conditions like minimum occupation period (MOP) for this 2nd flat.

Good luck!

Regards

Hi. I am single at age of 50 this year. I just sold my first subsidies 2room flexi this month. May I know whether I still eligible for second timer single 2room flexi?

Hi Mike thanks for the enquiry. For applying for a 2 room flexi (99 years) as a single, you can do it only once as a first timer. Hence, you can only apply as a second timer if your marital changes (for 2 room 99 years or bigger flats) or if you turn 55 years old (for 2 room short lease).

Hope that helps.

As a 66 year senior. I have purchased with HDB once. Got forced to repurchase 2nd time by SERS 20years ago. Am thinking of downgrading to a smaller flat. Am I allowed to purchase a 2room flat with 99 year lease or am I only limited to short lease below 45years.

Hello Mr Tan

You are right indeed. Benefits under SERS (whether in the form of lump sum payment or a new replacement BTO flat) counts as housing subsidy.

As such it is very unlikely you can qualify through a normal BTO route for a 2 ROOM 99-year lease (as opposed to the Senior route discussed here).

I am not sure but since the SERS was thrust upon you and not of your choosing, perhaps you can try appealing, but I am guessing chances are not high, but who knows …..

Hope that helps.

Regards

Jasmine

When is the Nov 2022 BTO open for application please

Hi Linda,

Based on past BTO exercises, HDB does not pre-announce the actual date when BTO flats are open for applications on HDB InfoWEB.

The announcement will be made on the same day when it is open for applications.

For example, the press release for the Aug 2022 BTO exercise was done on 30 Aug 2022, the very same day when it is open for applications.

Hence, you can check news portals, keep checking back on HDB Flat Portal website (https://homes.hdb.gov.sg/home/landing) or subscribe to their eAlert service here: https://services2.hdb.gov.sg/webapp/BF08CESS/ to be alerted to the actual launch day.

Since we are almost into Nov 2022, it is anytime soon.

Cheers & Best of Luck

Brandon